The sip calculator uses the following formula to generate results. For monthly salarywages gaji more than RM1000 and up to RM4000 you may refer to this infographic of the EIS Contribution Table Kadar Caruman SIP.

How Is The Interest Rate On Sip Calculated Quora

If you earn below 150000 per year then you are allowed each year to deposit up to 100 of your income into a SIPP this is called your annual SIPP allowance.

. The applicable rate of interest is 5. This calculation only applicable to Loss of Employment LOE starting from 1st January 2021 until 30th June 2022For LOE. That is called your annual SIPP allowance.

Theres a limit to how much you can. According to the EIS contribution table 02 will be paid by the. A SIP is a vehicle offered.

The rate of contribution under this category is 125 of employees monthly wages payable by the employer based on the contribution schedule. For LOE starting from 1st January 2021 until 30th June 2022 click HERE to calculate your benefit. BENEFIT CALCULATOR SIP PRIHATIN Note.

The rate of return per month would be 1212 1100001 Hence in a year you will get approximately 12809. Employment Insurance EIS contributions are set at 04 of an employees estimated monthly wage. Contribution Payment Per Month.

For those who make less than 150000 a year each year your allowable deposit is up to 100 of your UK income in your SIPP. The total amount that he gets back is Rs 10000500Rs 10500-. The rate of return applied to your contributions determines the final amount that you receive on maturity or when.

Small contributions from individuals are helping households manage their finances through disciplined investing. Per annum 5 75 10 125 15 175 20. Contribution Payment Per Year.

Visit The Official Edward Jones Site. Partnership shares You can buy shares out of your salary before tax deductions. The first category is only applicable to employees who are below the age of 60.

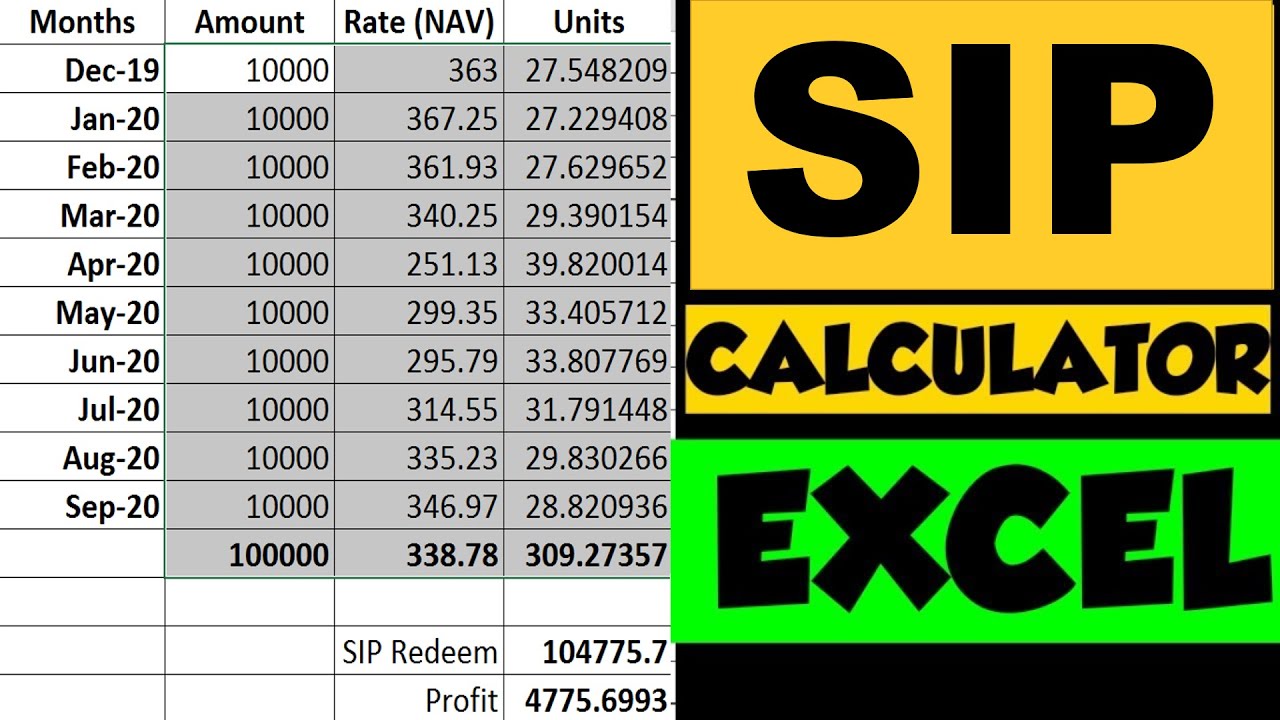

As illustrated in case of a monthly SIP of INR 10000 every month this instalment would create units in the mutual fund based on the NAV at which the units are allotted. Your employer can give you up to 3600 of free shares in any tax year. You get a rough estimate on the maturity amount for any monthly SIP based on a.

SIP contributions can be made weekly monthly quarterly or in lump sum. 15 Lakhs tax deduction under section 80C of the Income Tax Act. Your equity fund SIP redemptions are taxable only if your gains from equities exceed Rs 1 lakh in a year.

In the second category which is calculated at the rate of 125 of the total monthly salary. 100 in some cases can be made while purchasing a SIP. 500 or even Rs.

How much annually increase monthly SIP. The amount of investment under SIP has no barrier making it easy and. Fv p 1 in 1 i 1 i.

This calculator helps you calculate the wealth gain and expected returns for your monthly SIP investment. New Look At Your Financial Strategy. If your investment objective is tax savings then you can do an SIP of Rs.

All employees who have reached the age of. 12500 per month to get Rs. Where fv future value earned upon maturity p fixed investment through sip i.

Tax rates are different for equity and non-equity funds. Ad Do Your Investments Align with Your Goals. Find a Dedicated Financial Advisor Now.

To get the SIP. An investment amount as low as Rs. Sip Interest Rate As SIP allows investors to invest small amounts of money systematically instead of a lump sum the investment can be done on a weekly monthly and quarterly basis.

Per annum 0 15 30 45 60. Benefits are calculated based on your previous assumed salary and your. About SIP calculator online.

At the end of 365 days he gets an interest of 5 of 10000 Rs. When you start a SIP a fixed amount is invested quarterly monthly or. What rate of return do you expect.

Systematic Investment Plan Calculator Calculate your expected returns below by entering the amount you want to invest tenure of investment and the expected rate of return. However do keep in mind that the rate of interest on Mutual Funds. For instance if you want to calculate the FV for a SIP with 1000 monthly contributions for two years and an expected rate of return of 12 this is what the formula would look like for you.

Rate of Contribution Self-Employment Social Security Scheme Act 789 No.

Annual Top Up Can Help You Double Your Mutual Fund Investment Mint

Lump Sum Sip Calculator Financeplusinsurance

Nsc Calculator Tax Saving Investment Public Provident Fund Safe Investments

7 Different Types Of Sip Which Type Suits You The Most Why

6 Best Investment Options For Nris In India Marketing De Contenidos Infografia Marketing

Pin By Chelsea Nauman On Design Inspiration Pollination Queen Bees Design Inspiration

Invest The Right Sip Amount Systematic Investment Plan Investing Investment Business Ideas

How Share Incentive Plans Sips Shares Work Global Shares

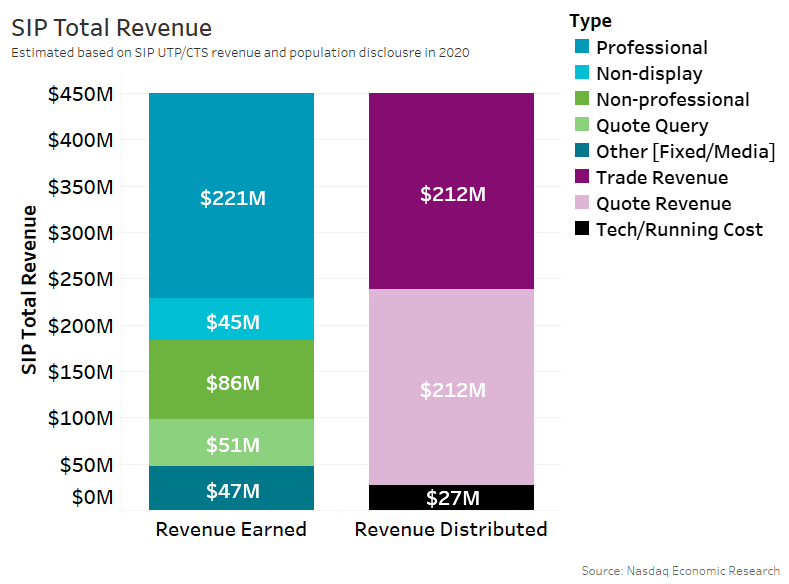

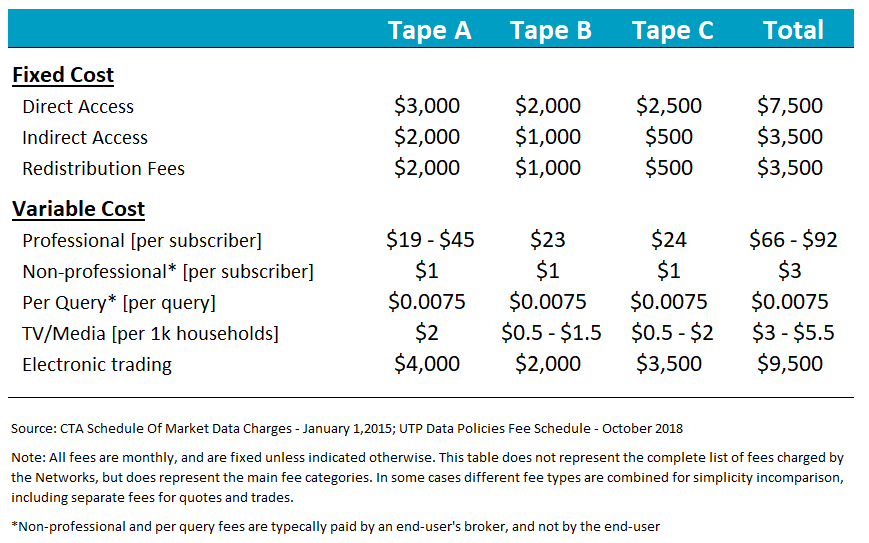

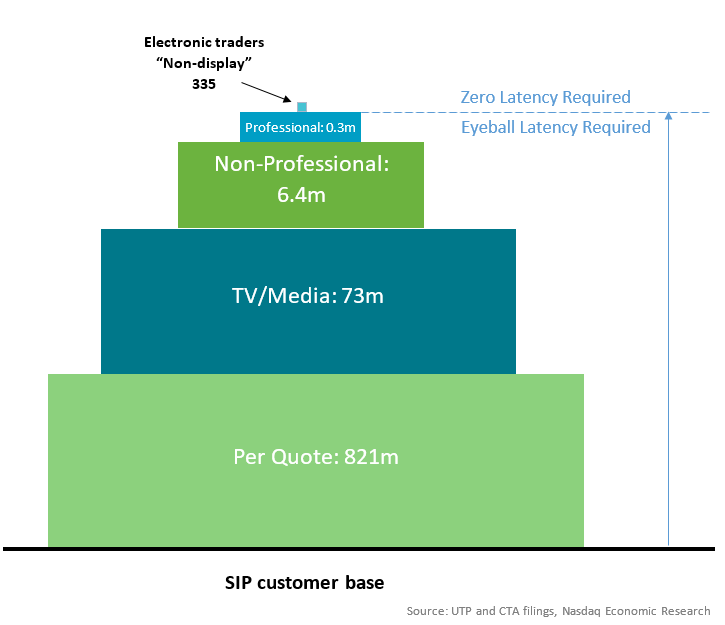

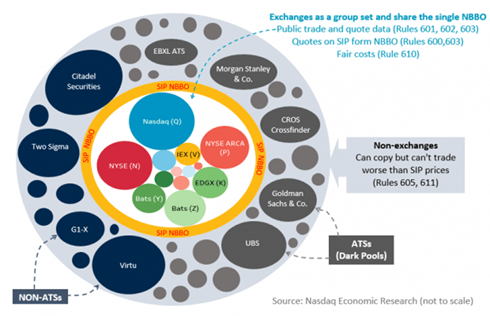

How The U S Sip Really Works The World Federation Of Exchanges

How The U S Sip Really Works The World Federation Of Exchanges

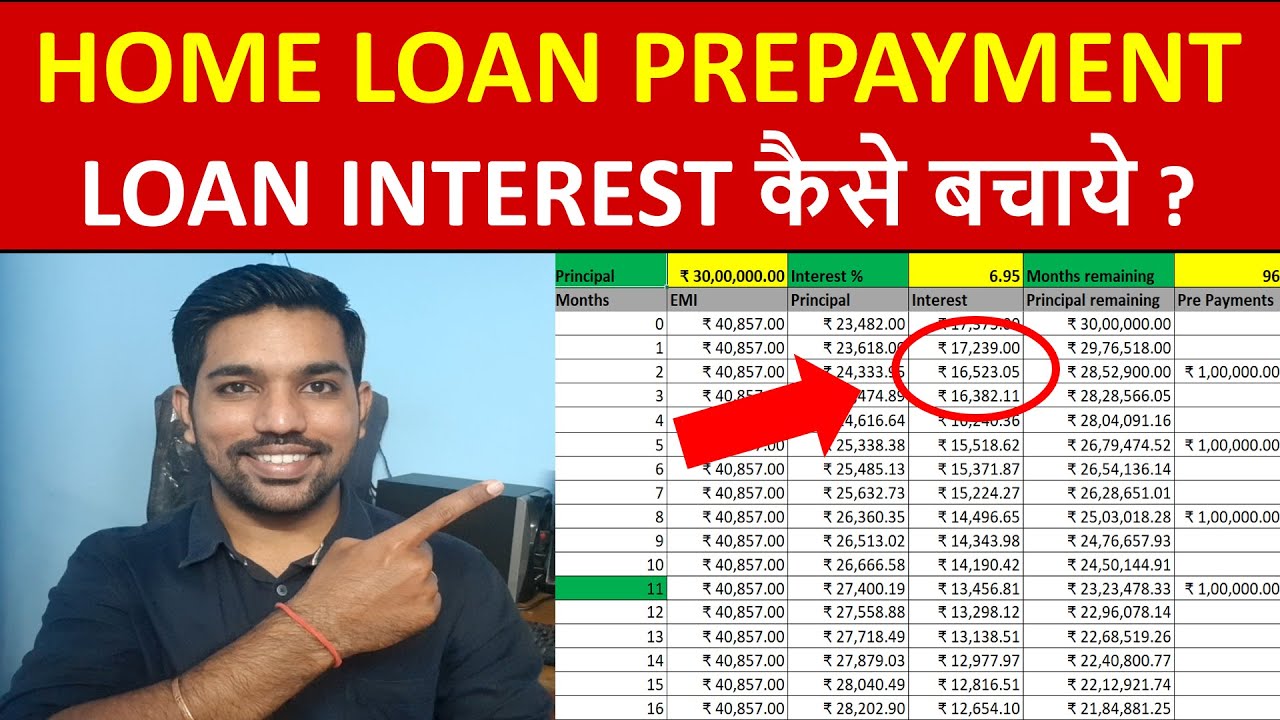

Sip Returns Excel Calculator Sip Vs Lump Sum Returns Systematic Investment Planning Explained Youtube

Reclaim Physio Home Physio Rehab Center Promote Your Business

![]()

Different Types Of Systematic Investment Plan In India Uti Mutual Fund

Sip Returns Excel Calculator Sip Vs Lump Sum Returns Systematic Investment Planning Explained Youtube

Should You Buy Sukanya Samriddhi Yojana Mutuals Funds Economic Times Article Writing

How The U S Sip Really Works The World Federation Of Exchanges

How Does Sip Mode Benefit The Investor Businesstoday

How The U S Sip Really Works The World Federation Of Exchanges